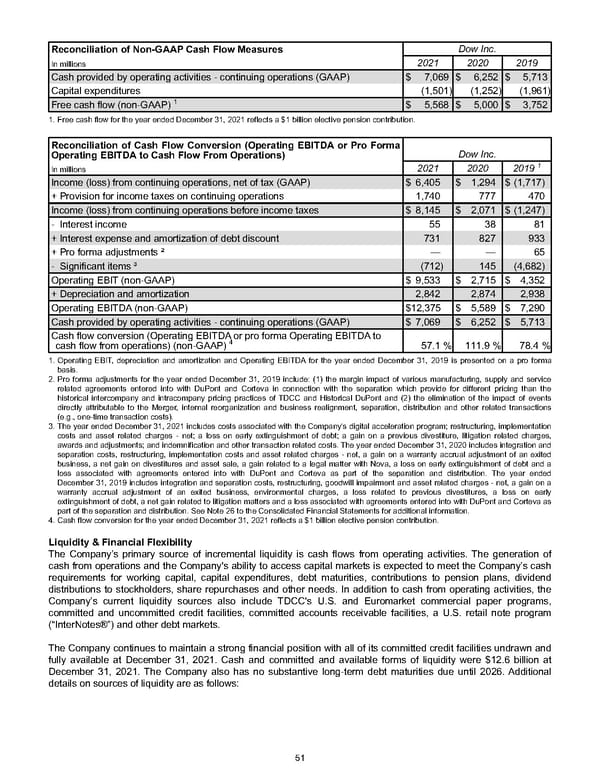

Reconciliation of Non-GAAP Cash Flow Measures Dow Inc. In millions 2021 2020 2019 Cash provided by operating activities - continuing operations (GAAP) $ 7,069 $ 6,252 $ 5,713 Capital expenditures (1,501) (1,252) (1,961) Free cash flow (non-GAAP) 1 $ 5,568 $ 5,000 $ 3,752 1. Free cash flow for the year ended December 31, 2021 reflects a $1 billion elective pension contribution. Reconciliation of Cash Flow Conversion (Operating EBITDA or Pro Forma Operating EBITDA to Cash Flow From Operations) Dow Inc. In millions 2021 2020 2019 1 Income (loss) from continuing operations, net of tax (GAAP) $ 6,405 $ 1,294 $ (1,717) + Provision for income taxes on continuing operations 1,740 777 470 Income (loss) from continuing operations before income taxes $ 8,145 $ 2,071 $ (1,247) - Interest income 55 38 81 + Interest expense and amortization of debt discount 731 827 933 + Pro forma adjustments ² — — 65 - Significant items ³ (712) 145 (4,682) Operating EBIT (non-GAAP) $ 9,533 $ 2,715 $ 4,352 + Depreciation and amortization 2,842 2,874 2,938 Operating EBITDA (non-GAAP) $ 12,375 $ 5,589 $ 7,290 Cash provided by operating activities - continuing operations (GAAP) $ 7,069 $ 6,252 $ 5,713 Cash flow conversion (Operating EBITDA or pro forma Operating EBITDA to cash flow from operations) (non-GAAP) 4 57.1 % 111.9 % 78.4 % 1. Operating EBIT, depreciation and amortization and Operating EBITDA for the year ended December 31, 2019 is presented on a pro forma basis. 2. Pro forma adjustments for the year ended December 31, 2019 include: (1) the margin impact of various manufacturing, supply and service related agreements entered into with DuPont and Corteva in connection with the separation which provide for different pricing than the historical intercompany and intracompany pricing practices of TDCC and Historical DuPont and (2) the elimination of the impact of events directly attributable to the Merger, internal reorganization and business realignment, separation, distribution and other related transactions (e.g., one-time transaction costs). 3. The year ended December 31, 2021 includes costs associated with the Company's digital acceleration program; restructuring, implementation costs and asset related charges - net; a loss on early extinguishment of debt; a gain on a previous divestiture, litigation related charges, awards and adjustments; and indemnification and other transaction related costs. The year ended December 31, 2020 includes integration and separation costs, restructuring, implementation costs and asset related charges - net, a gain on a warranty accrual adjustment of an exited business, a net gain on divestitures and asset sale, a gain related to a legal matter with Nova, a loss on early extinguishment of debt and a loss associated with agreements entered into with DuPont and Corteva as part of the separation and distribution. The year ended December 31, 2019 includes integration and separation costs, restructuring, goodwill impairment and asset related charges - net, a gain on a warranty accrual adjustment of an exited business, environmental charges, a loss related to previous divestitures, a loss on early extinguishment of debt, a net gain related to litigation matters and a loss associated with agreements entered into with DuPont and Corteva as part of the separation and distribution. See Note 26 to the Consolidated Financial Statements for additional information. 4. Cash flow conversion for the year ended December 31, 2021 reflects a $1 billion elective pension contribution. Liquidity & Financial Flexibility The Company’s primary source of incremental liquidity is cash flows from operating activities. The generation of cash from operations and the Company's ability to access capital markets is expected to meet the Company’s cash requirements for working capital, capital expenditures, debt maturities, contributions to pension plans, dividend distributions to stockholders, share repurchases and other needs. In addition to cash from operating activities, the Company’s current liquidity sources also include TDCC's U.S. and Euromarket commercial paper programs, committed and uncommitted credit facilities, committed accounts receivable facilities, a U.S. retail note program (“InterNotes®”) and other debt markets. The Company continues to maintain a strong financial position with all of its committed credit facilities undrawn and fully available at December 31, 2021 . Cash and committed and available forms of liquidity were $12.6 billion at December 31, 2021 . The Company also has no substantive long-term debt maturities due until 2026. Additional details on sources of liquidity are as follows: 51

Annual Report Page 60 Page 62

Annual Report Page 60 Page 62