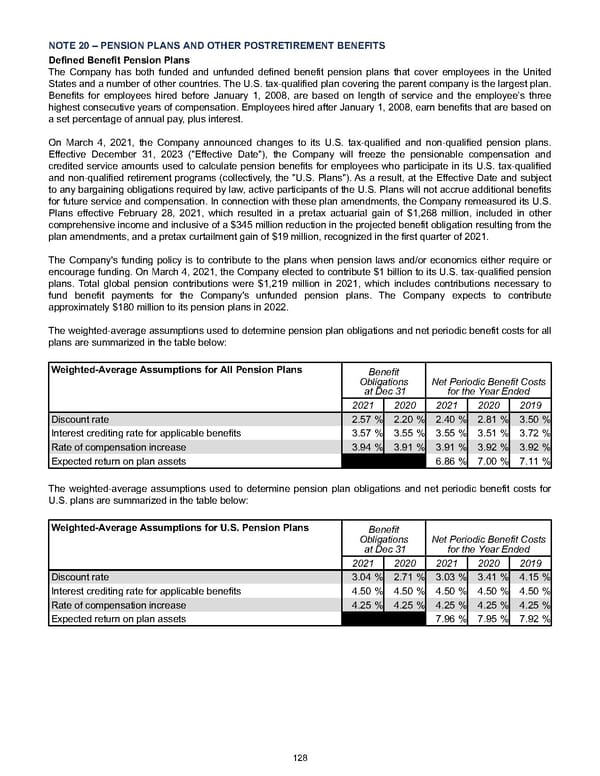

NOTE 20 – PENSION PLANS AND OTHER POSTRETIREMENT BENEFITS Defined Benefit Pension Plans The Company has both funded and unfunded defined benefit pension plans that cover employees in the United States and a number of other countries. The U.S. tax-qualified plan covering the parent company is the largest plan. Benefits for employees hired before January 1, 2008, are based on length of service and the employee’s three highest consecutive years of compensation. Employees hired after January 1, 2008, earn benefits that are based on a set percentage of annual pay, plus interest. On March 4, 2021, the Company announced changes to its U.S. tax-qualified and non-qualified pension plans. Effective December 31, 2023 ("Effective Date"), the Company will freeze the pensionable compensation and credited service amounts used to calculate pension benefits for employees who participate in its U.S. tax-qualified and non-qualified retirement programs (collectively, the "U.S. Plans"). As a result, at the Effective Date and subject to any bargaining obligations required by law, active participants of the U.S. Plans will not accrue additional benefits for future service and compensation. In connection with these plan amendments, the Company remeasured its U.S. Plans effective February 28, 2021, which resulted in a pretax actuarial gain of $1,268 million , included in other comprehensive income and inclusive of a $345 million reduction in the projected benefit obligation resulting from the plan amendments, and a pretax curtailment gain of $19 million , recognized in the first quarter of 2021. The Company's funding policy is to contribute to the plans when pension laws and/or economics either require or encourage funding. On March 4, 2021, the Company elected to contribute $1 billion to its U.S. tax-qualified pension plans. Total global pension contributions were $1,219 million in 2021 , which includes contributions necessary to fund benefit payments for the Company's unfunded pension plans. The Company expects to contribute approximately $180 million to its pension plans in 2022 . The weighted-average assumptions used to determine pension plan obligations and net periodic benefit costs for all plans are summarized in the table below: Weighted-Average Assumptions for All Pension Plans Benefit Obligations at Dec 31 Net Periodic Benefit Costs for the Year Ended 2021 2020 2021 2020 2019 Discount rate 2.57 % 2.20 % 2.40 % 2.81 % 3.50 % Interest crediting rate for applicable benefits 3.57 % 3.55 % 3.55 % 3.51 % 3.72 % Rate of compensation increase 3.94 % 3.91 % 3.91 % 3.92 % 3.92 % Expected return on plan assets 6.86 % 7.00 % 7.11 % The weighted-average assumptions used to determine pension plan obligations and net periodic benefit costs for U.S. plans are summarized in the table below: Weighted-Average Assumptions for U.S. Pension Plans Benefit Obligations at Dec 31 Net Periodic Benefit Costs for the Year Ended 2021 2020 2021 2020 2019 Discount rate 3.04 % 2.71 % 3.03 % 3.41 % 4.15 % Interest crediting rate for applicable benefits 4.50 % 4.50 % 4.50 % 4.50 % 4.50 % Rate of compensation increase 4.25 % 4.25 % 4.25 % 4.25 % 4.25 % Expected return on plan assets 7.96 % 7.95 % 7.92 % 128

Annual Report Page 137 Page 139

Annual Report Page 137 Page 139