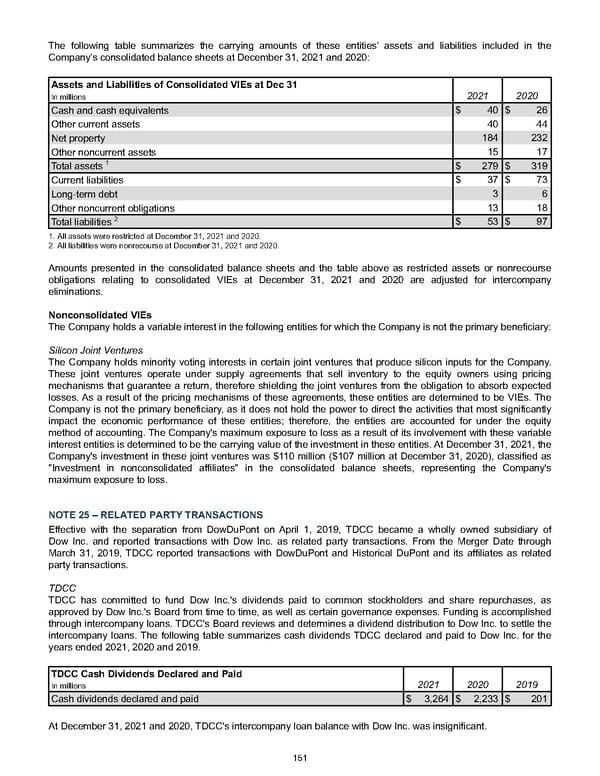

The following table summarizes the carrying amounts of these entities’ assets and liabilities included in the Company’s consolidated balance sheets at December 31, 2021 and 2020 : Assets and Liabilities of Consolidated VIEs at Dec 31 In millions 2021 2020 Cash and cash equivalents $ 40 $ 26 Other current assets 40 44 Net property 184 232 Other noncurrent assets 15 17 Total assets 1 $ 279 $ 319 Current liabilities $ 37 $ 73 Long-term debt 3 6 Other noncurrent obligations 13 18 Total liabilities 2 $ 53 $ 97 1. All assets were restricted at December 31, 2021 and 2020 . 2. All liabilities were nonrecourse at December 31, 2021 and 2020 . Amounts presented in the consolidated balance sheets and the table above as restricted assets or nonrecourse obligations relating to consolidated VIEs at December 31, 2021 and 2020 are adjusted for intercompany eliminations. Nonconsolidated VIEs The Company holds a variable interest in the following entities for which the Company is not the primary beneficiary: Silicon Joint Ventures The Company holds minority voting interests in certain joint ventures that produce silicon inputs for the Company. These joint ventures operate under supply agreements that sell inventory to the equity owners using pricing mechanisms that guarantee a return, therefore shielding the joint ventures from the obligation to absorb expected losses. As a result of the pricing mechanisms of these agreements, these entities are determined to be VIEs. The Company is not the primary beneficiary, as it does not hold the power to direct the activities that most significantly impact the economic performance of these entities; therefore, the entities are accounted for under the equity method of accounting. The Company's maximum exposure to loss as a result of its involvement with these variable interest entities is determined to be the carrying value of the investment in these entities. At December 31, 2021 , the Company's investment in these joint ventures was $110 million ( $107 million at December 31, 2020 ), classified as "Investment in nonconsolidated affiliates" in the consolidated balance sheets, representing the Company's maximum exposure to loss. NOTE 25 – RELATED PARTY TRANSACTIONS Effective with the separation from DowDuPont on April 1, 2019, TDCC became a wholly owned subsidiary of Dow Inc. and reported transactions with Dow Inc. as related party transactions. From the Merger Date through March 31, 2019, TDCC reported transactions with DowDuPont and Historical DuPont and its affiliates as related party transactions. TDCC TDCC has committed to fund Dow Inc.'s dividends paid to common stockholders and share repurchases, as approved by Dow Inc.'s Board from time to time, as well as certain governance expenses. Funding is accomplished through intercompany loans. TDCC's Board reviews and determines a dividend distribution to Dow Inc. to settle the intercompany loans. T he following table summarizes cash dividends TDCC declared and paid to Dow Inc. for the years ended 2021 , 2020 and 2019 . TDCC Cash Dividends Declared and Paid 2021 2020 2019 In millions Cash dividends declared and paid $ 3,264 $ 2,233 $ 201 At December 31, 2021 and 2020 , TDCC's intercompany loan balance with Dow Inc. was insignificant. 151

Annual Report Page 160 Page 162

Annual Report Page 160 Page 162