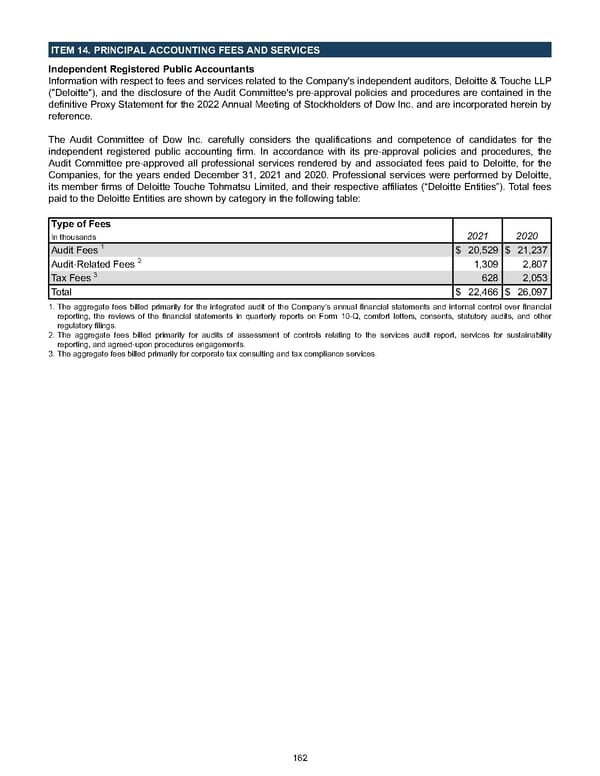

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES Independent Registered Public Accountants Information with respect to fees and services related to the Company's independent auditors, Deloitte & Touche LLP ("Deloitte"), and the disclosure of the Audit Committee's pre-approval policies and procedures are contained in the definitive Proxy Statement for the 2022 Annual Meeting of Stockholders of Dow Inc. and are incorporated herein by reference. The Audit Committee of Dow Inc. carefully considers the qualifications and competence of candidates for the independent registered public accounting firm. In accordance with its pre-approval policies and procedures, the Audit Committee pre-approved all professional services rendered by and associated fees paid to Deloitte, for the Companies, for the years ended December 31, 2021 and 2020 . Professional services were performed by Deloitte, its member firms of Deloitte Touche Tohmatsu Limited, and their respective affiliates (“Deloitte Entities”). Total fees paid to the Deloitte Entities are shown by category in the following table: Type of Fees In thousands 2021 2020 Audit Fees 1 $ 20,529 $ 21,237 Audit-Related Fees 2 1,309 2,807 Tax Fees 3 628 2,053 Total $ 22,466 $ 26,097 1. The aggregate fees billed primarily for the integrated audit of the Company's annual financial statements and internal control over financial reporting, the reviews of the financial statements in quarterly reports on Form 10-Q, comfort letters, consents, statutory audits, and other regulatory filings. 2. The aggregate fees billed primarily for audits of assessment of controls relating to the services audit report, services for sustainability reporting, and agreed-upon procedures engagements. 3. The aggregate fees billed primarily for corporate tax consulting and tax compliance services. 162

Annual Report Page 171 Page 173

Annual Report Page 171 Page 173