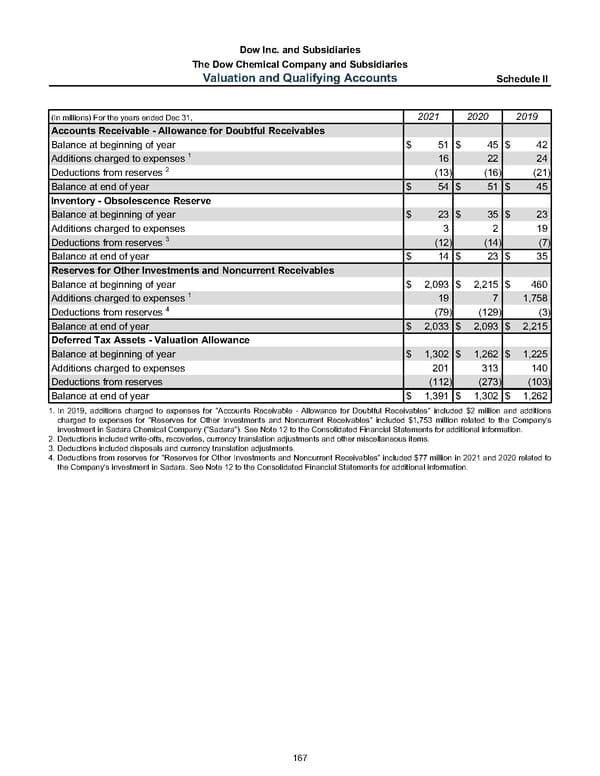

Dow Inc. and Subsidiaries The Dow Chemical Company and Subsidiaries Valuation and Qualifying Accounts Schedule II (In millions) For the years ended Dec 31, 2021 2020 2019 Accounts Receivable - Allowance for Doubtful Receivables Balance at beginning of year $ 51 $ 45 $ 42 Additions charged to expenses 1 16 22 24 Deductions from reserves 2 (13) (16) (21) Balance at end of year $ 54 $ 51 $ 45 Inventory - Obsolescence Reserve Balance at beginning of year $ 23 $ 35 $ 23 Additions charged to expenses 3 2 19 Deductions from reserves 3 (12) (14) (7) Balance at end of year $ 14 $ 23 $ 35 Reserves for Other Investments and Noncurrent Receivables Balance at beginning of year $ 2,093 $ 2,215 $ 460 Additions charged to expenses 1 19 7 1,758 Deductions from reserves 4 (79) (129) (3) Balance at end of year $ 2,033 $ 2,093 $ 2,215 Deferred Tax Assets - Valuation Allowance Balance at beginning of year $ 1,302 $ 1,262 $ 1,225 Additions charged to expenses 201 313 140 Deductions from reserves (112) (273) (103) Balance at end of year $ 1,391 $ 1,302 $ 1,262 1. In 2019, additions charged to expenses for "Accounts Receivable - Allowance for Doubtful Receivables" included $2 million and additions charged to expenses for "Reserves for Other Investments and Noncurrent Receivables" included $1,753 million related to the Company's investment in Sadara Chemical Company ("Sadara"). See Note 12 to the Consolidated Financial Statements for additional information. 2. Deductions included write-offs, recoveries, currency translation adjustments and other miscellaneous items. 3. Deductions included disposals and currency translation adjustments. 4. Deductions from reserves for "Reserves for Other Investments and Noncurrent Receivables" included $77 million in 2021 and 2020 related to the Company's investment in Sadara. See Note 12 to the Consolidated Financial Statements for additional information. 167

Annual Report Page 176 Page 178

Annual Report Page 176 Page 178