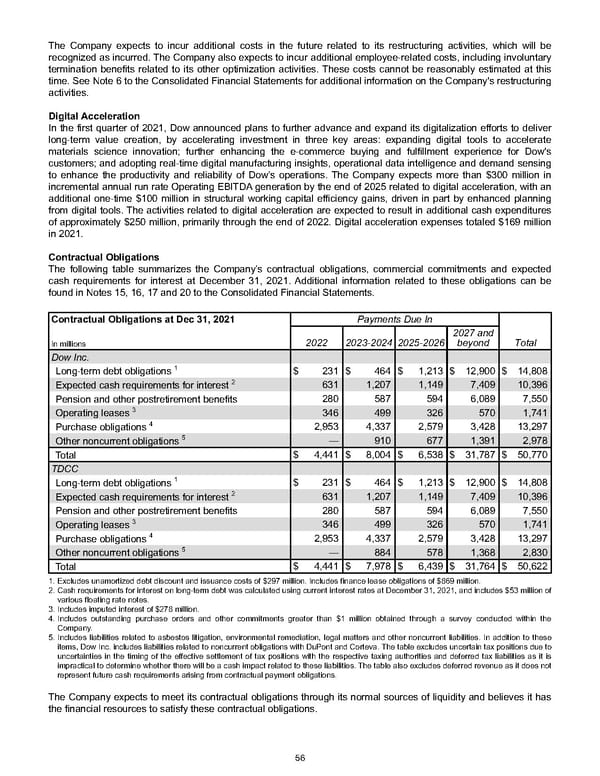

The Company expects to incur additional costs in the future related to its restructuring activities, which will be recognized as incurred. The Company also expects to incur additional employee-related costs, including involuntary termination benefits related to its other optimization activities. These costs cannot be reasonably estimated at this time. See Note 6 to the Consolidated Financial Statements for additional information on the Company's restructuring activities. Digital Acceleration In the first quarter of 2021, Dow announced plans to further advance and expand its digitalization efforts to deliver long-term value creation, by accelerating investment in three key areas: expanding digital tools to accelerate materials science innovation; further enhancing the e-commerce buying and fulfillment experience for Dow's customers; and adopting real-time digital manufacturing insights, operational data intelligence and demand sensing to enhance the productivity and reliability of Dow’s operations. The Company expects more than $300 million in incremental annual run rate Operating EBITDA generation by the end of 2025 related to digital acceleration, with an additional one-time $100 million in structural working capital efficiency gains, driven in part by enhanced planning from digital tools. The activities related to digital acceleration are expected to result in additional cash expenditures of approximately $250 million, primarily through the end of 2022. Digital acceleration expenses totaled $169 million in 2021 . Contractual Obligations The following table summarizes the Company’s contractual obligations, commercial commitments and expected cash requirements for interest at December 31, 2021 . Additional information related to these obligations can be found in Notes 15 , 16 , 17 and 20 to the Consolidated Financial Statements. Contractual Obligations at Dec 31, 2021 Payments Due In In millions 2022 2023-2024 2025-2026 2027 and beyond Total Dow Inc. Long-term debt obligations 1 $ 231 $ 464 $ 1,213 $ 12,900 $ 14,808 Expected cash requirements for interest 2 631 1,207 1,149 7,409 10,396 Pension and other postretirement benefits 280 587 594 6,089 7,550 Operating leases 3 346 499 326 570 1,741 Purchase obligations 4 2,953 4,337 2,579 3,428 13,297 Other noncurrent obligations 5 — 910 677 1,391 2,978 Total $ 4,441 $ 8,004 $ 6,538 $ 31,787 $ 50,770 TDCC Long-term debt obligations 1 $ 231 $ 464 $ 1,213 $ 12,900 $ 14,808 Expected cash requirements for interest 2 631 1,207 1,149 7,409 10,396 Pension and other postretirement benefits 280 587 594 6,089 7,550 Operating leases 3 346 499 326 570 1,741 Purchase obligations 4 2,953 4,337 2,579 3,428 13,297 Other noncurrent obligations 5 — 884 578 1,368 2,830 Total $ 4,441 $ 7,978 $ 6,439 $ 31,764 $ 50,622 1. Excludes unamortized debt discount and issuance costs of $297 million . Includes finance lease obligations of $869 million . 2. Cash requirements for interest on long-term debt was calculated using current interest rates at December 31, 2021 , and includes $53 million of various floating rate notes. 3. Includes imputed interest of $278 million . 4. Includes outstanding purchase orders and other commitments greater than $1 million obtained through a survey conducted within the Company. 5. Includes liabilities related to asbestos litigation, environmental remediation, legal matters and other noncurrent liabilities. In addition to these items, Dow Inc. includes liabilities related to noncurrent obligations with DuPont and Corteva. The table excludes uncertain tax positions due to uncertainties in the timing of the effective settlement of tax positions with the respective taxing authorities and deferred tax liabilities as it is impractical to determine whether there will be a cash impact related to these liabilities. The table also excludes deferred revenue as it does not represent future cash requirements arising from contractual payment obligations. The Company expects to meet its contractual obligations through its normal sources of liquidity and believes it has the financial resources to satisfy these contractual obligations. 56

Annual Report Page 65 Page 67

Annual Report Page 65 Page 67